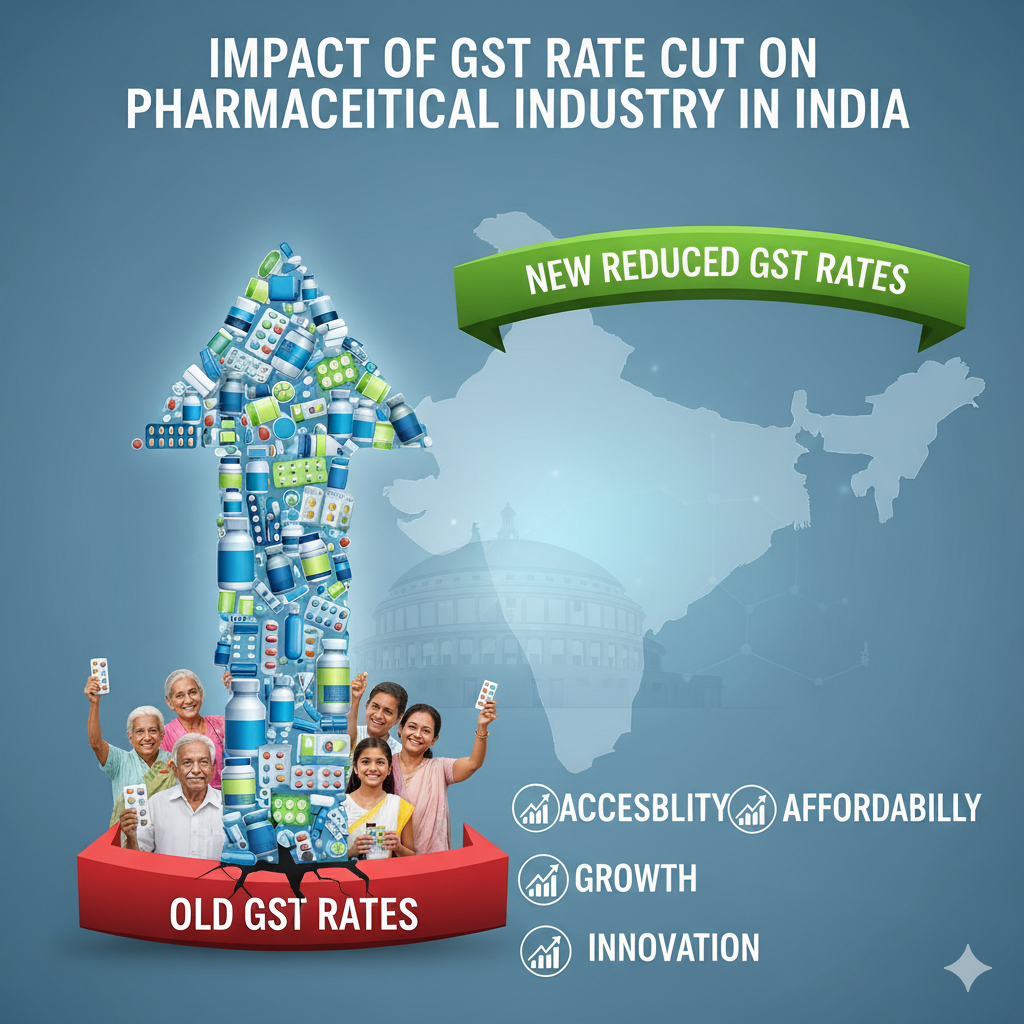

Impact of GST Rate Cut on Pharmaceutical Industry in India: The pharma industry plays an imperative role in ensuring affordable healthcare not only domestically but also internationally. The recent GST(Goods and Services Tax) rate reduction on certain drugs, as well as medical products, by the government has sparked significant debate among industry experts, economists, and medical professionals.

This rate cut is not only a fiscal adjustment; it has far-reaching implications for medicine pricing, patient affordability, profit margins, and overall healthcare access. In this blog, we will provide you with the information about the Impact of GST Rate Cut on Pharmaceutical Industry in India in the ensuing paragraphs.

What Changed in 2025?

In a great move in September 2025, the GST(Goods and Services Tax) Council decreased tax rates on many essential healthcare items, so have a look at the Impact of GST Rate Cut on Pharmaceutical Industry in India:

| Item | Old GST Rate | New GST Rate |

| Essential medicines | 12% | 5% |

| Life-saving drugs, like cancer and rare diseases | 5% or 12% | 0% (fully exempt) |

| Diagnostic kits and devices | 12% | 5% |

| Medical services, such as job work | 12% | 5% |

How Does This Change Help The Customers?

GST(Goods and Services Tax) rate reduction on pharmaceutical products is really helpful for the customers because now the medicine has become affordable for those who find it difficult to buy life-saving medicines. Here are certain points that define the Impact of the GST Rate Cut on the Pharmaceutical Industry in India and how it helps customers:

- Drugs Become More Affordable: There is a drop of 7% which may not sound like much, but for patients who take blood pressure, diabetes, and other chronic illnesses medicines regularly, this adds up. Now, families can save thousands of rupees every year. For instance, ₹25,000 cancer injection – now ₹23,000–₹24,000 and ₹1,000 medicine per month → now ₹950 or less.

- More Individuals Can Access Healthcare: Lower prices mean more people, especially in rural or poor areas, can now afford life-saving medicines, regular diagnostic tests, and health check-ups. This improves public health and decreases the number of individuals who skip treatment because it is too expensive for them.

- Boost to Indian Pharma Organizations: The lower tax rates do not impact the pharma companies; they can still maintain profit. Owing to the reduction in the rate of medicines, the demand for medicines would increase. Therefore, more affordable means more buyers internationally. The companies can invest more in R&D as well as innovation, which is a win-win situation for both business and consumers.

- Encourages Use of Better Technology: GST cuts on medical devices as well as diagnostic kits make it easier for labs to upgrade their equipment. Individuals can buy home-use kits, like glucose monitors, pregnancy tests, and more. This supports early diagnosis as well as preventive care.

Some Challenges Are To Face, After the GST Rate Cut

You know that every coin has two sides. Have a look at a few concerns mentioned below:

Will the Benefit Reach the Customer?

Even though taxes are cut but there are certain companies that may not decrease medicine prices, owing to keeping an extra margin. Therefore, the government has told organizations to update MRPs as well as pass the advantage to individuals.

Raw Materials Still Costly

It is good that medicines have become more affordable for customers, but not for all medicines. Certain medicines’ costly raw material still keeps their price high. Therefore, companies have to spend more on inputs, which decreases their profits.

Old Stock Problems

Another challenge is old stock. The companies, as well as pharmacies, have old stock that they have to relabel or remark with the new price. It creates confusion among customers, and the company has to adjust billing software. All this may take months to fully reflect the new price everywhere.

Impact of GST Rate Cut on Pharmaceutical Industry as a Whole

| Stakeholder Group | Impact |

| Patients | Lower medicine prices lead to improved access to healthcare. |

| Pharmaceutical Companies | Increase sales volumes, but may need to adjust profit margins. |

| Hospitals & Diagnostic Laboratories | Benefit from reduced input costs, more affordable tests, and other medical services. |

| Retailers & Chemists | Need to update MRPs, billing systems, and inventory records accordingly. |

| Government | Experience a decline in tax revenue; however, improved public health results can offset this in the long term. |

Wrapping Up!

Healthcare should always be affordable, not a luxury. The GST rate reduction on the pharmaceutical industry in India makes it possible for individuals to buy life-saving drugs, like cancer and rare diseases, which are expensive. If companies properly implement this GST rate reduction, then it could make it possible for people to buy medicines at affordable prices for better diagnostics and making healthier India. Hope the “Impact of GST Rate Cut on Pharmaceutical Industry in India” blog provides you with all the information you are searching for.

call us

call us whatsapp

whatsapp Contact Us

Contact Us